New in Vertec: Sealing accounting documents

More and more companies are switching to a purely electronic document filing system, including and especially for accounting documents such as accounts for creditors and invoices received. However, these documents, which are relevant for tax and financial statements, have special requirements in terms of storage and proof requirements – unlike a purely, traditional paper filing system.

Companies must keep accounting documents for a long time. In Switzerland, it is 10 years; in Germany, this deadline (for new financial years) was recently reduced to 8 years – but until 2035 the 10-year rule will still apply. In Austria, the period is usually 7 years.

How electronic documents are to be stored so that they continue to be valid postings is specified in all countries by specific laws or regulations. In principle, however, they are all the same: the documents must be saved unalterably and it must be possible to prove this.

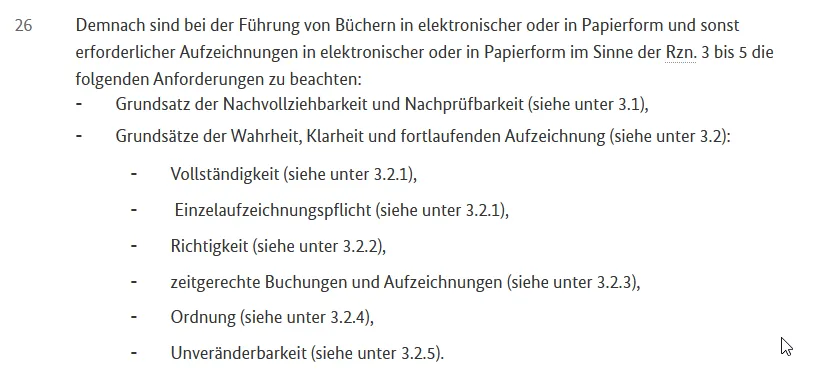

In Germany, the GoBD applies. In Article 3, paragraph 26, the following is found:

3.2.5 then reads: “A posting or a record may not be altered in such a way that its original content is no longer identifiable. Nor may such changes be made the nature of which leaves it uncertain whether they were originally made or only subsequently made”.

Paragraph 138 also states: “An electronic signature or timestamp is not required for taxation purposes.” Not “required,” but permissible.

In Switzerland, Article 9 of the GeBüV applies:

When creating it, the authors obviously thought of external media, because CDs and DVDs are not subject to any additional requirements, as the media are considered immutable. But this seems to me to be no longer a viable solution, because CD drives are a thing of the past – even more so in 10 years’ time! You then have a medium on which data is unaltered, but you can’t read it.

Modifiable electronic data carriers (and I also include DMS systems!) are permissible if technical measures guarantee the integrity and immutability of the data for a period of 10 years. This requires certified methods, such as electronic signatures and timestamps, as well as documentation of the processes.

In the case of a document with a signature with a timestamp (or better: sealed so that there is no confusion with electronic signatures), it can be proven beyond any doubt that it has certainly not changed since the date of the timestamp. If the document were to be altered even slightly, the seal would appear to be no longer valid.

For PDFs, the usual storage format, this is built into the standard and Adobe Acrobat Reader then displays such signatures or seals, including the time since the document was no longer modified.

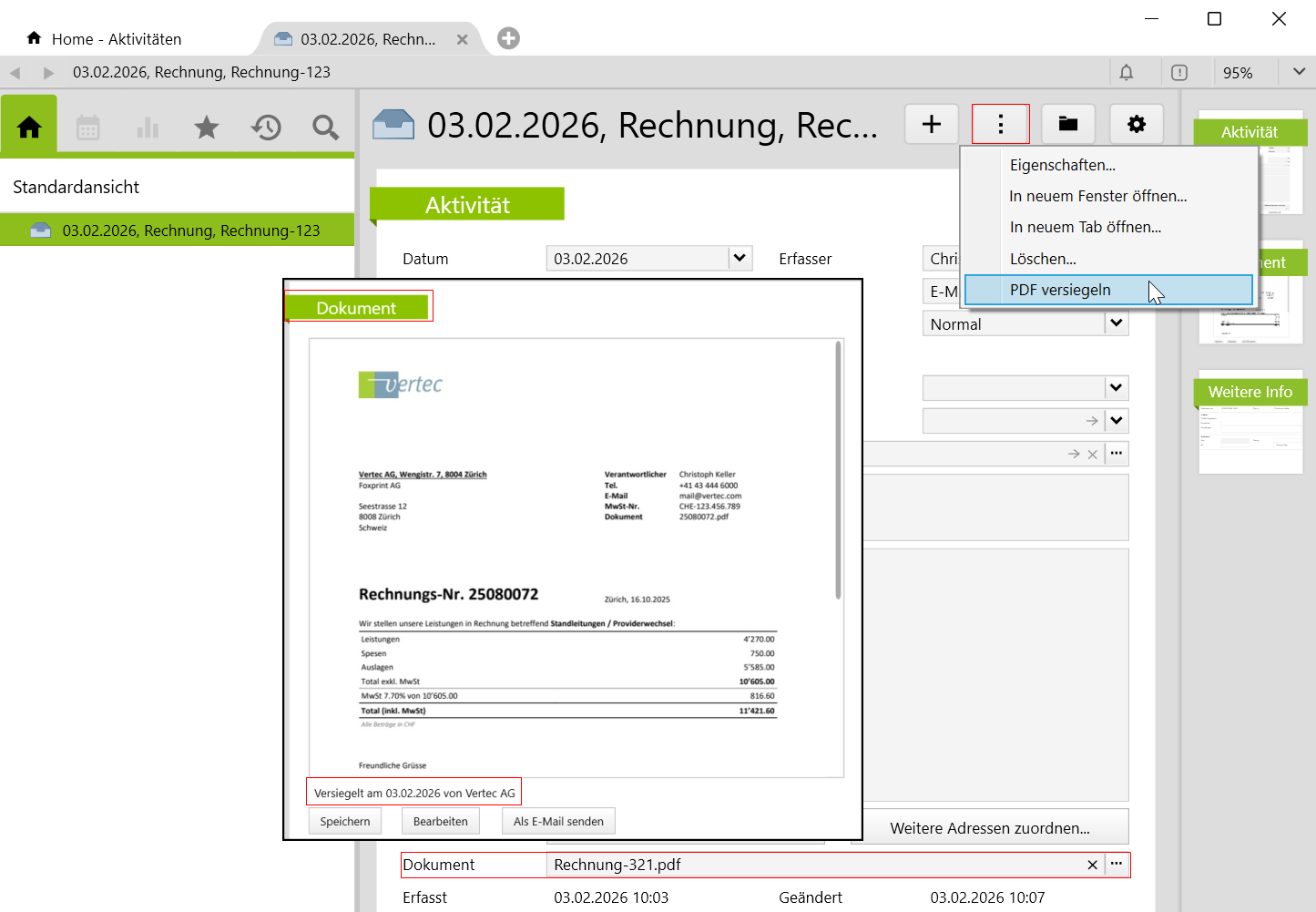

In order to enable our customers to archive their accounting documents as easily, cost-effective and legally compliant as possible – especially with regard to accounts payable and incoming invoices – we are releasing version sealing function with Version 6.8.0.16

The sealing function is available free of charge to all Vertec customers with a licensed module “Procurement & Purchases”. The sealing is done by a cloud service of ours, but this is designed to be very privacy friendly: The actual document (i.e. the PDF) is not sent to this cloud service, but only a hash of it. The fact that a document has been sealed is visible directly in Vertec and, as already mentioned, can also be confirmed with Acrobat Reader or online validators.